Starting January 1, 2026, Italy has adopted a new €2 fee (contribution) on shipments with a value of up to €150 originating from non-EU countries.

The measure, included in the 2026 Budget Law (Law No. 199/2025), aims – according to the legislator – to cover the customs management costs of so-called “small parcels” and to curb low-cost imports that in recent years have characterized international eCommerce logistics.

The provision is generating broad debate among logistics operators, eCommerce businesses, and institutions, especially in view of the new European customs regime set to enter into force in mid-2026.

On December 12, the Council of the European Union approved a fixed €3 customs duty on shipments under €150, which will enter into force on July 1, 2026.

The Italian measure and the European one differ in amount, legal nature, and timing, and they raise a central issue for eCommerce and logistics operators: how will the two frameworks be coordinated in practice?

In this article, we analyze in detail what the Italian regulation provides, what will change from July 1, 2026 under the European regime, and what the concrete impacts will be for eCommerce businesses, supply chain operators, and consumers.

What Is the New 2026 eCommerce Parcel Fee?

The new 2026 eCommerce parcel fee is a contribution toward the customs management of low-value parcels.

The 2026 Budget Law introduces a fixed €2 contribution on parcels whose declared value does not exceed €150, originating from non-EU countries, at the time of final importation—that is, at the moment of customs clearance in Italy.

The contribution is therefore intended to cover administrative and customs control costs, not to function as a customs duty in the strict sense.

The fee applies regardless of whether customs duties are otherwise due. Under current European legislation, shipments from non-EU countries with a value below €150 are exempt from customs duties, but not from VAT. Since July 1, 2021, VAT has been due on all commercial imports, regardless of the value of the goods.

With the introduction of the Italian contribution, the exemption from customs duties below €150 is not modified. What changes is that these micro-shipments, while still exempt from customs duties, are now subject to an additional fixed €2 charge at the time of release for free circulation.

2026 eCommerce Parcel Fee: Legal Framework Between Italian Contribution and EU Customs Reform

The €150 threshold is not accidental: at the European level, it has historically been the value below which imported goods were not subject to customs duties.

As mentioned above, in 2025 the Council of the European Union decided to apply a fixed €3 duty, starting July 1, 2026, on parcels valued below €150 for all extra-EU eCommerce imports.

This means that, by 2026, micro-shipments will be subject not only to a national Italian regime but also to a European fiscal framework.

Difference Between the €2 Italian Contribution and the €3 EU Duty

The Italian measure provides for a fixed €2 contribution on parcels from non-EU countries with a value below €150.

The EU duty, effective from July 2026, is a fixed €3 customs duty on all parcels under €150 entering the European Union, regardless of national legislation.

The combined effect could therefore result in a double charge on certain imports, unless Italy coordinates its framework with the new European regime.

Coordination Between the Italian Contribution and the European Customs Reform: What the Law Says

The 2026 Budget Law (Art. 1, paragraphs 126–128) states that the €2 Italian contribution applies in compliance with the Union Customs Code (EU Regulation No. 952/2013), which governs customs value, release for free circulation, and customs clearance procedures.

However, the legislative text (paragraphs 126–128 of the 2026 Budget Law) does not provide an explicit coordination mechanism with the new €3 European duty entering into force on July 1, 2026. The national law currently contains no substitution clause, automatic suspension mechanism, or harmonization provision with the future EU framework.

This means that, in the absence of legislative coordination, the issue of whether the two measures are cumulative or substitutive will need to be clarified through future legislative amendments or interpretative acts.

For eCommerce businesses and logistics operators, this regulatory uncertainty is particularly relevant, as cross-border cost planning for the second half of 2026 will depend on potential corrective measures or clarifications introduced in the coming months.

Why the 2026 eCommerce Parcel Fee Was Introduced

The decision to introduce the €2 contribution on micro-shipments comes in the context of strong growth in eCommerce imports from non-EU countries, particularly from Asia.

According to several national economic newspapers, the Government justified the measure by the need to address the exponential increase in low-value parcels from international platforms such as Shein, Temu, and AliExpress, which in recent years have significantly impacted Italian and European customs flows.

The stated objective is twofold: on the one hand, to strengthen customs control capacity, including combating under-invoicing and declaration irregularities; on the other, to rebalance competitive conditions between non-EU operators and Italian companies, particularly in the fashion, retail, and consumer goods sectors, where price competition is especially intense.

The measure also fits within the broader European debate on revising the low-value shipment regime, which the Council of the European Union has linked to the need to ensure greater fiscal fairness and sustainability of customs systems in light of increasing cross-border eCommerce volumes.

The Impact of the 2026 Parcel Fee on eCommerce

Higher Shipping Costs

For eCommerce businesses that frequently import low-value parcels—for example, via dropshipping—the €2 contribution translates into a fixed cost for every shipment under €150.

Even a seemingly small amount, when applied to high volumes, can significantly affect cost structures. In practice, eCommerce operators face several direct effects:

-

Increased variable logistics costs, especially for models based on frequent, low unit-value shipments.

-

Pressure on margins, particularly in low mark-up sectors where even a few euros per order can erode operating profit.

-

The need to revise free shipping policies, which may become less sustainable or subject to higher minimum order thresholds.

-

An incentive to increase average cart value, thereby spreading the fixed contribution over higher amounts and reducing its percentage impact per order.

For operators managing large volumes of micro-orders, the €2 contribution becomes a strategic variable to integrate into pricing strategy, supply chain management, and commercial policies—not merely an administrative cost.

Charging Methods: Who Actually Pays the 2026 eCommerce Parcel Fee?

One of the most relevant issues for operators concerns cost allocation: who ultimately bears the fee?

From a legal perspective, the obligation arises in the customs sphere, but commercially, the decision on how to pass it along the value chain is strategic. The main options are:

-

Direct charge to the end customer at checkout, with explicit indication of the contribution among shipping fees or additional charges. This is the most transparent solution but may negatively affect conversion rates, especially for low-value orders.

-

Absorbing the cost within the eCommerce business, without modifying the final price. In this case, the impact is a reduction in margins, particularly significant in low mark-up sectors.

-

Hybrid management through marketplaces and platforms, where the contribution may be incorporated into commissions, logistics tariffs, or fulfillment services, distributing its economic impact along the value chain.

This choice is strategic, as it affects price positioning, consumer perception, and competitiveness vis-à-vis intra-EU operators. For many cross-border players, the €2 contribution becomes a variable to integrate into commercial and pricing policies rather than a simple administrative expense.

The Impact of the 2026 Parcel Fee on Logistics Operators and Carriers

The introduction of the €2 contribution has also produced immediate effects on logistics flows.

According to reports from national newspapers, in the first twenty days of January 2026 there was a 38% drop in shipments under €150 compared to the same period the previous year, a figure confirmed by the Italian Customs Agency.

The most notable case concerns Malpensa Cargo, Italy’s main freight hub, where several operators began shifting flights to other European hubs and then reaching Italy by truck. This decision increases road mileage, with potentially negative effects on overall transport costs and the environmental impact of the supply chain.

How to Respond to the 2026 eCommerce Parcel Fee: Logistics Efficiency and Out-of-Home Delivery

If the €2 contribution introduces a fixed cost per micro-shipment, the response from eCommerce businesses and logistics operators cannot be limited to revising prices or commercial terms. The issue becomes structural: increased costs must be offset by addressing supply chain inefficiencies, particularly in the last mile, where a significant share of logistics expenses is concentrated.

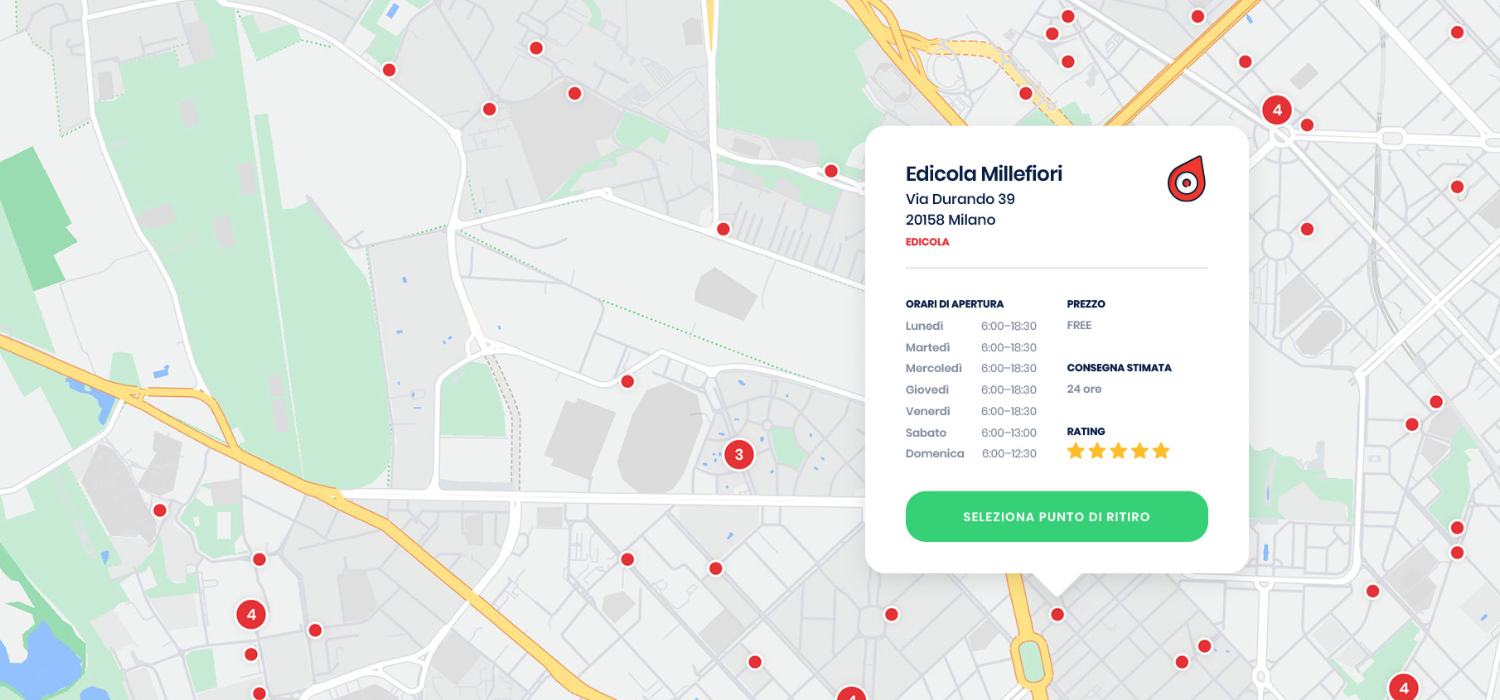

Out-of-Home delivery through lockers and pickup points fits precisely into this scenario as a concrete optimization lever.

By consolidating deliveries in physical points distributed across the territory, failed delivery attempts are reduced, storage times shortened, and urban route fragmentation limited.

In the traditional home delivery model, each shipment entails a variable cost linked to distance, traffic, and the probability of recipient absence. In an Out-of-Home model, the courier makes multiple deliveries to a single point, improving vehicle load factors and flow predictability.

This approach directly impacts the average cost per delivery, which becomes the key variable when fixed charges per shipment are introduced.

Consolidating volumes in strategic locations reduces territorial dispersion, contains operating costs, and improves environmental sustainability thanks to fewer kilometers traveled and lower emissions.

In this context, access to an extensive and interoperable network of over 500,000 lockers and pickup points such as GEL Proximity’s network represents a strategic asset for operators seeking to preserve competitiveness and margins. Wide coverage enables rapid integration of the Out-of-Home model into checkout and fulfillment processes, offering customers flexibility while optimizing delivery efficiency.

In this sense, the mini-parcel fee can be viewed not only as an additional cost but also as a transformation accelerator. In a market where rules can change rapidly—between national regulations and European reforms—the ability to rely on a broad, scalable, and shared logistics infrastructure becomes decisive in building more resilient and sustainable distribution models.

Sharing Economy and Public-Private Collaboration

Finally, the new fiscal context opens a broader reflection on the role of urban logistics infrastructure.

Rising per-shipment costs and increasing regulatory complexity make it clear that last-mile distribution cannot be managed as a sum of closed and fragmented networks, but rather as shared infrastructure integrated into the urban fabric.

In this scenario, an evolved model of public-private cooperation is emerging, based on interoperable logistics infrastructures such as shared delivery point networks accessible to multiple operators and integrated into urban neighborhoods, as well as public-private agreements for developing proximity hubs and lockers within sustainable mobility and urban regeneration policies.

The issue, therefore, is not only the physical presence of pickup points but their integration into an interoperable digital infrastructure capable of interacting with checkout systems, fulfillment platforms, and diverse transport networks. It is the shift from proprietary infrastructure to shared and connected infrastructure that enables duplication reduction, flow optimization, and greater resilience of the logistics system.

In several European cities, models based on interoperable locker networks and proximity hubs are already becoming integral parts of sustainable urban logistics strategies. In a context where even a fixed per-shipment contribution can alter economic balances, having access to a widespread, accessible, and scalable physical and digital infrastructure becomes a decisive competitive factor for eCommerce and logistics operators.

From this perspective, the mini-parcel fee is not merely a cost to absorb but a catalyst accelerating the transition toward more integrated, interoperable, and collaborative logistics models.

In short, the €2 fee on low-value parcels is certainly one of the most debated aspects of the 2026 fiscal framework. While it aims to rebalance competition and strengthen customs control capacity, it also requires a profound revision of logistics cost structures and supply chain strategies, especially for eCommerce businesses and international operators.

In a transforming European context, where a common customs regime will enter into force on July 1, 2026, adopting efficient logistics strategies—such as Out-of-Home delivery models—becomes essential to contain marginal costs and mitigate the impact of fixed per-parcel charges.

If you manage an eCommerce business, discover now how to optimize your delivery costs thanks to GEL Proximity’s network of over 500,000 Pickup Points and Lockers.

Contact us for a personalized consultation and turn the 2026 parcel fee into an opportunity for logistics efficiency.