Austria, with its strategic location in the heart of Europe and a growing economy, is a key market for eCommerce.

What makes the eCommerce market in Austria unique

What makes Austria a particularly attractive market is in fact a unique combination of factors. On the one hand, its geographical location in the heart of Europe facilitates logistical operations and trade flows with neighbouring countries such as Germany, Italy and Switzerland. On the other hand, the level of digitisation of the population is remarkable: almost all households have access to the Internet (97%, according to the European e-Commerce Report 2024) and the increase in mobile Internet penetration (expected to be 90% by 2028) further strengthens its relevance as a digital market.

Austrians are sophisticated digital consumers who expect smooth, personalised shopping experiences in line with their needs. It is therefore not surprising that eCommerce in Austria is booming, with the market value continuing to grow at a fast pace.

The importance of eCommerce in Austria, however, goes far beyond the country’s borders. Its linguistic and cultural proximity to Germany, one of the largest eCommerce markets in the world, makes Austria a strategic starting point for testing products and strategies before expanding further into the DACH region (Germany, Austria, Switzerland); and with a population that is highly sensitive to issues such as sustainability and digital innovation, Austria is an ideal laboratory for testing innovative solutions, such as Out Of Home deliveries, which are revolutionising logistics and consumer behaviour.

In short, Austria is not only a promising market for eCommerce, but a showcase for the future of eCommerce in Europe. To ignore it would therefore mean missing one of the most strategic opportunities in the European digital landscape

eCommerce in Austria: data and perspectives

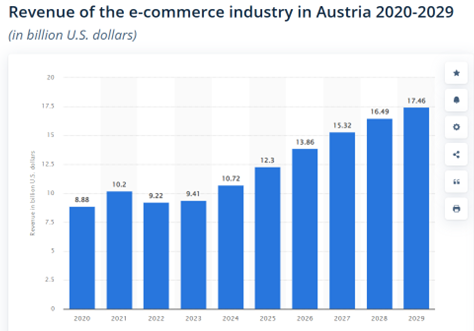

eCommerce in Austria is a fast-growing sector, so much so that Statista forecasts that by 2025 the eCommerce market turnover in the country will reach USD 12.30 billion, with an annual growth rate (CAGR 2025-2029) of 9.15 per cent, with an expected market volume of USD 17.46 billion by 2029.

Fonte grafico: Statista

How many Austrian eShoppers there are

97% of Austrians have access to the Internet; of these, 79% have already made an online purchase at least once.

Compared to other European countries, Austria is only in the middle of the European ranking in terms of number of eShoppers; however, what is interesting is the rapid growth in recent years.

In 2019, eShoppers were only 69% of the population. In 2020, with Covid, this rose to 66%, a percentage that remained unchanged until 2022 (in 2021, there was even a drop to 63%), but it was in 2023 that the unstoppable growth began. From 66% of eShoppers, this rose to 72%, and the following year, 2024, marked the highest percentage ever recorded in the country: 79%. This is a symptom that more and more consumers are moving to eCommerce and will most likely continue to grow in the coming years.

eCommerce market trends in Austria

The eCommerce landscape in Austria is constantly evolving, driven by a number of trends reflecting changes in consumer preferences and technological developments.

Mobile Commerce in constant growth

The use of smartphones for online shopping has seen significant growth in recent years. Whereas in 2017 only 33% of Austrian consumers used mobile devices for online shopping, by 2022 this percentage had risen to 71%, with further expansion expected in the coming years.

Austrian eShoppers increasingly rely on dedicated apps and mobile-friendly versions of eCommerce sites, preferring platforms that offer fast and secure payment processes and an intuitive user experience.

Increasing focus on sustainability

Sustainability is a priority for Austrian eShoppers. For this reason, the demand for eco-friendly products, recyclable packaging and environmentally friendly delivery methods is constantly increasing. Retailers offering ‘green’ shipping options, such as consolidated deliveries or centralised pick-up points, therefore enjoy a significant competitive advantage.

Furthermore, the possibility of choosing reusable packaging or offsetting the carbon footprint of the shipment is highly appreciated.

Leading marketplace and local competition

Amazon.de dominates the eCommerce market in Austria, followed by Zalando, MediaMarkt and Shop Apotheke. However, there is increasing competition from local and regional platforms that focus on in-depth market knowledge and the ability to offer products specific to Austrian culture and traditions.

According to data from the latest European E-Commerce Report, in fact, in 2024 71% of Austrian eShoppers completed their online purchases on national sellers’ sites; 69% from sites in other European countries, and only 24% from sites in non-European countries.

Localisation, including language adaptation and the use of dialects, is a key success factor for online stores.

Social Commerce and Omnichannelality

The role of social media in eCommerce in Austria, as well as worldwide, is expanding rapidly.

Approximately 80 per cent of Austrians use social platforms such as Facebook, Instagram and TikTok, and more and more users discover products and services directly through advertisements or sponsored posts. In addition, the omnichannel approach, which integrates online and offline shopping experiences, is gaining in popularity: many retailers already offer Click&Collect options, or allow products purchased online to be returned to their physical shops.

Expansion of rapid deliveries

Speed of delivery is becoming a decisive aspect for Austrian eShoppers. More and more consumers expect same-day delivery (40% of Austrian eShoppers) or even within a few hours of ordering, especially in urban areas.

This clearly expressed consumer need is driving logistics companies to invest in innovative solutions, such as urban micro-hubs and electric vehicles, to ensure a faster and greener service. As a result, more and more eShoppers are beginning to appreciate the convenience of these solutions, acting as a growth engine for Out Of Home delivery across Europe.

Out Of Home deliveries in Austria

Austria is establishing itself as the European leader in Out Of Home (OOH) deliveries. According to data from the latest report ‘Out Of Home Delivery in Europe 2024’ there are already 5,928 OOH points in Austria, divided into 3,505 Pick-up Points and 2,423 Lockers for collecting online orders. If this seems small compared to other European countries, bear in mind that Austria has an area of 83,871 square kilometres, and 70% of the territory is mountainous.

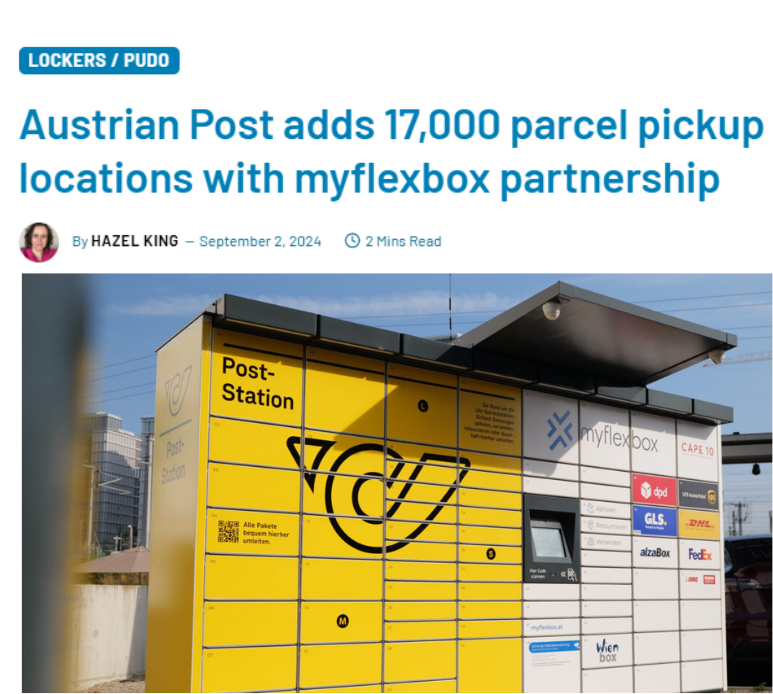

Furthermore, thanks to a new agreement between Austrian Post – the Austrian Post – and myflexbox Austria, signed last September, Austrian eShoppers will have more pick-up points available for their online orders. Austrian Post, relying on the 550 myflexbox stations across the country, will make 17,000 additional pick-up points available to consumers, enabling almost 80 per cent of all parcels in Austria to be received via Locker.

“The cooperation with myflexbox will enable Austrians to have at least one pick-up point in close proximity,” commented Walter Oblin, future CEO of Österreichische Post. Jonathan Grothaus, co-CEO and founder of myflexbox, added: ‘All major shipping service providers are now united under one roof and offer the full range of services, such as pick-up, shipping and return. Austria is thus the first country in Europe where all major shipping services are fully integrated into a single parcel station network‘.

Do you also want to integrate Lockers and Pick-up Points to your eCommerce immediately? Choose GEL Proximity! We can offer you over 200,000 Pick-up Points already active throughout Europe. Contact us now and find out how.