In 2025, out of home delivery in Europe will no longer be an alternative, but the norm. Driven by new consumer habits, the growth of re-commerce and increasingly stringent requirements in terms of efficiency and sustainability, out-of-home delivery has established itself as the most concrete response to the complex challenges of the last mile.

This is according to the 2025 edition of the ‘Out Of Home Delivery in Europe‘ report published by Last Mile Experts, one of the most comprehensive analyses of the state of the industry at a continental level. The study analyses 32 European countries (including the United Kingdom, Switzerland and Ukraine) and provides a detailed snapshot of out-of-home networks, shipment volumes, key operators and the new technological dynamics that are changing the way parcels are delivered.

The picture that emerges is clear: PUDO (Pick-Up Drop-Off) and APM (Automated Parcel Machines, i.e. Lockers) networks are now widespread, increasingly interoperable and integrated into the logistics flows of postal operators, couriers and eCommerce.

In this article, we guide you through the ‘Out Of Home Delivery in Europe’ report, analysing the most interesting data that has emerged and the state of the art of out-of-home deliveries in Europe.

The state of Out-of-Home Delivery in Europe in 2025

In Europe, there are currently 646,480 active OOH points, of which 462,080 are PUDOs and 184,400 are APMs: a significant increase compared to the figures presented in last year’s report, when the total number of points was 504,130, according to data collected at the end of 2023.

The leading country is still Poland, which stands out both for the absolute number of lockers (45,325) and for density: 17.3 points per 10,000 inhabitants. It is followed by France (17,510 APMs), the United Kingdom (15,565) and Ukraine (13,098). Spain (10,905 lockers) and Italy are also among the leaders, with 60,322 unique PUDOs, confirming their position among the fastest growing markets.

Who are the main operators for Out Of Home delivery in Europe

The main operators in Europe are currently:

- DHL/Deutsche Post: with 191,030 OOH points between PUDO and APM

- DPD (Geopost): with a total of 142,020 OOH points

- GLS: with 136,070 OOH points

- InPost: with 91,510 OOH points

- UPS: with 86,850 OOH points

Lockers and PUDOs: open, agnostic and expanding networks

One of the most significant trends for 2025 is undoubtedly the opening up of OOH networks. More and more postal operators and couriers are abandoning the closed models of the past in favour of shared, carrier-agnostic infrastructures.

This is the case, for example, with the partnership between DHL and Poste Italiane, which aims to create a joint network of over 10,000 APMs in Italy and the Iberian Peninsula.

The technological offering is also evolving: smarter lockers, real-time integrations, modular APIs, premium pickups and new features such as temperature control. The goal? To maximise utilisation rates and improve the customer experience.

Comparison with 2024: a year of structural growth

Compared to 2024, the growth of Out Of Home delivery is clear:

- +11% total OOH points (from approximately 584,000 points to 646,480)

- In Italy alone, there has been an increase from 48,310 to 60,322 PUDOs, equal to +25%

- As for lockers, there has been a 20% increase across Europe.

On the tech front, the Out Of Home Delivery in Europe 2025 report shows how APIs, software platforms, and advanced digital services are becoming key parts of managing Out of Home logistics. In particular, there is growing adoption of real-time integrations between eCommerce systems, couriers and OOH networks, which enable automatic shipment status updates, simplify dynamic pick-up point allocation and offer greater visibility to end users.

The most advanced software solutions also enable direct monetisation of OOH services through features such as premium pick-up, differentiated charges based on storage time, and access to business intelligence data useful to retailers and logistics operators. Last mile automation is therefore increasingly linked to the availability of flexible and modular technologies that enable more efficient, customisable and scalable delivery models.

The advantages of out-of-home delivery for e-commerce and couriers

The success of out-of-home delivery is no accident, but a direct consequence of the tangible benefits it offers throughout the logistics chain.

Firstly, it drastically reduces the number of failed delivery attempts: for example, in high-density markets such as Germany and the United Kingdom, up to 25% of home deliveries are not successful on the first attempt, generating additional costs and customer dissatisfaction.

The economic consequences are far from marginal: each failed delivery costs an average of €14 in Germany and £11.60 in the United Kingdom, with a direct impact on operators’ margins. The OOH model, on the other hand, eliminates this risk entirely: parcels are available at the location chosen by the customer without time constraints, thus increasing service reliability and reducing costs.

Added to these benefits is the environmental advantage: a single delivery to a locker or PUDO point can generate up to 82% fewer emissions than a door-to-door delivery. This figure highlights the potential of the OOH model as a lever for achieving supply chain sustainability goals.

All this also translates into greater operational efficiency. The case of InPost Poland is emblematic: during seasonal peaks, a single courier is able to make up to 1,500 daily deliveries to Lockers, compared to 150–250 for traditional home delivery. In practice, this means ten times more parcels handled in the same time, with a single vehicle.

Italy: growing numbers, but there is still a long way to go

With 60,322 active PUDOs, Italy remains one of the leading European markets in terms of the size of its Out of Home network, surpassing historically more structured countries such as Germany.

However, the picture changes when looking at density per inhabitant: with less than 10 points per 10,000 inhabitants, Italy remains below the European average, where countries such as Poland, the Czech Republic and Hungary easily exceed 12–17 points per 10,000 inhabitants.

This imbalance between absolute presence and territorial coverage reflects a growing market that is still heavily concentrated in large urban centres. The potential for development is enormous, especially in less well-served areas and in terms of interoperability between networks.

However, we will discuss all this in greater depth in our next article, with a specific focus on the state of the art of Out of Home delivery in Italy in 2025. We will take the time to provide more detailed information on the figures, trends and opportunities for OOH in Italy. An in-depth analysis dedicated to those who want to understand where the national market is really heading. Stay tuned!

GEL Proximity: technology at the service of out-of-home delivery

Have you already integrated Lockers and Pick-up Points into your online store to give your customers the option of picking up and returning their orders with maximum flexibility and convenience? Don’t get left behind, the future of last-mile logistics is already here!

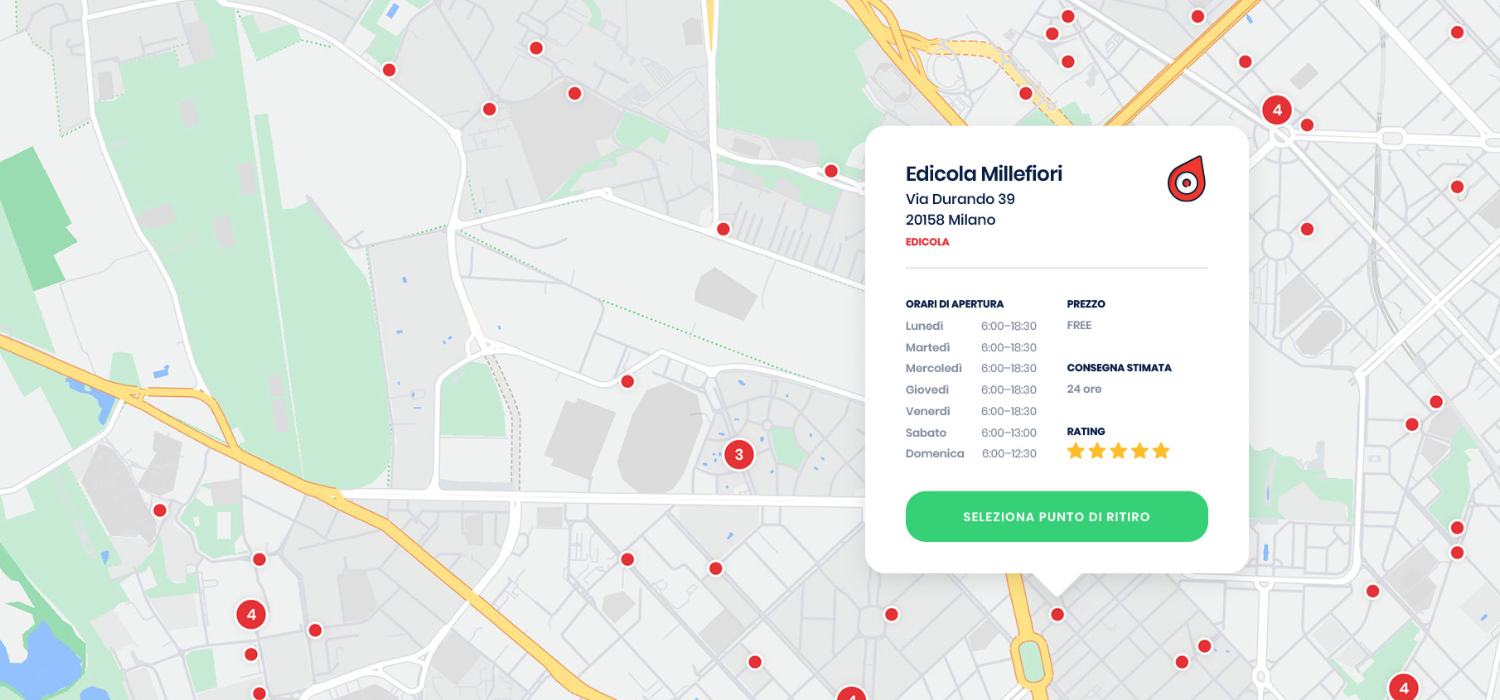

With GEL Proximity, you can easily integrate over 300,000 Pick-up Points and Lockers into your store, offering flexible, sustainable and personalised OOH deliveries.

For the first time, GEL Proximity is mentioned in the official Last Mile Experts report, on page 119, among the leading players in Europe! This is an important recognition that testifies to our strategic role in promoting logistics models with a positive impact.