The United Kingdom’s is one of the most developed digital markets in the world as well as one of the main destinations for Italian exports even if, as stated in the report “The eCommerce Market in the United Kingdom post Brexit” by the ICE Agency, “the long and troubled events related to the exit from the European Union have had heavy consequences.”

We then analyzed all the data related to eCommerce in the country to understand in which direction it is moving and how it is positioned compared to Italy.

How many Internet Users and e-Shoppers are in the UK

In 2022, Internet Users in the UK were 98 percent of the population; of these, 86 percent completed at least one online purchase during the year. This percentage is up 2% from 2021, thus placing the UK seventh in Europe in terms of the number of e-Shoppers.

As anticipated, however, the UK’s exit from the European Union, known as Brexit, formally announced by the British government in March 2017 and materialized on December 31, 2020, has also brought with it significant repercussions for e-commerce.

The number of British eShoppers, in fact, as evidenced by Eurostat/Statista data reported in the European Ecommerce Report 2022, after an increase between 2017 and 2020 when they reached 92 percent with £141.33 billion spent in the eCommerce market, declined by 8 percentage points in 2021 and only in 2022 returned to growth. Despite the decline in online consumers, eCommerce accounted for 37.1 percent of total retail sales in 2021, a figure that rose to 37.8 percent in 2022 and is estimated at 38.1 percent in 2023. By 2025, the percentage is estimated to reach 38.6 percent.

What are the main eShop sectors in the UK

The sector with the most online sales in the country is fashion with $25.2 billion spent online, followed by games, hobbies and DIY ($16.3 billion), electronics ($15.9 billion), food and personal care ($14.8 billion), and finally furniture and accessories ($12.4 billion).

Where British eShoppers shop

73 percent of online purchases are made on UK sites, 16 percent on EU sites, and the remaining 11 percent on exta-EU sites.

Benefiting the most from the increase in online retail demand, however, have been marketplaces and in particular Amazon, which with 446.5 million monthly visits reached £31.1 billion at the end of 2020. They were followed by eBay and ASOS, with 355.5 million and 54.3 million monthly visits, respectively; Argos with 51.2 million visits-an online store specializing in electronics, home and garden products, clothing, toys, and sports equipment; Asda (with 25.6 million visits per month) owned by U.S. giant Walmart; and Tesco with 25.5 million visits per month (Similarweb data).

Logistics for eCommerce in the UK

From the perspective of logistics for eCommerce, service levels are very high: delivery within 24 hours, Click & Collect, bookings with payment on delivery, and order status tracking are in fact valued and usual services for UK consumers.

UK eCommerce returns

Even from the perspective of returns, for which UK online shoppers are highly inclined (in 2020 they recorded a value of about 8.7 billion euros), the ability to choose between different ways of re-delivery of the parcel is considered crucial, and alternative methods to home collection are often preferred: 73 percent of UK eShoppers in fact go to the post office when returning a product; this is followed by courier collection (62 percent), at the point of sale (61 percent), at a Collection Point (47 percent), and finally, with 28 percent, delivery of returns at Lockers.

Lockers in the United Kingdom

Regarding just the Locker Network in the UK, last March InPost, a Polish logistics operator among the best known for Out Of Home services, announced that it had reached 5 thousand automated micro-hubs. InPost’s volumes in the third quarter of 2022 have in fact increased by 227 percent in the UK compared to the previous year, and more and more online consumers are requesting Out Of Home (OOH) delivery services.

Nationwide, are share of Lockers thus reaches 290,000 and nearly half of the residents in the cities of London, Birmingham, and Manchester live within a seven-minute walk of an InPost Locker. “Over the past 12 months, we have seen great demand in the UK for convenient, hassle-free parcel delivery services, and the pace of growth shows that this mindset is here to stay,” said Michael Rouse, CEO of InPost International, further emphasizing that “at a time when major cities are looking to reduce road traffic and polluting emissions, OOH options represent a real and impactful solution to meet community needs.

Locker to support retail sales

A choice that, as mentioned above, also helps physical commerce, since according to research conducted in collaboration with Lidl, more than half of the users (54 percent) who used an InPost Locker located in a UK Lidl store then also made a purchase at the retail outlet, confirming that using the Locker was the primary reason for the purchase.

Click and Collect services in the UK

As for the UK market for Click and Collect services, however, according to the GlobalData report, online sales using this delivery method reached £9.6 billion in 2022, representing 12.9 percent of total online spending. More than 40 percent of physical stores in the UK thus already offer this service for pickup and return of online orders (Barclays data), and more and more brands are implementing the service in retail stores.

In other words, on the front of delivery alternatives to traditional Home Delivery, the UK proves to be ahead of Italy for the moment, although this opens up the opportunity that soon in our country too we will see the development of a real Out Of Home culture capable of making eCommerce more sustainable, both environmentally and economically.

GEL Proximity: the solution for your eCommerce

If you are an eCommerce manager and you don’t want to miss the opportunity to offer your customers the possibility to pick up their online orders at Locker and Collection Points or in Click and Collect mode, GEL Proximity has the solution.

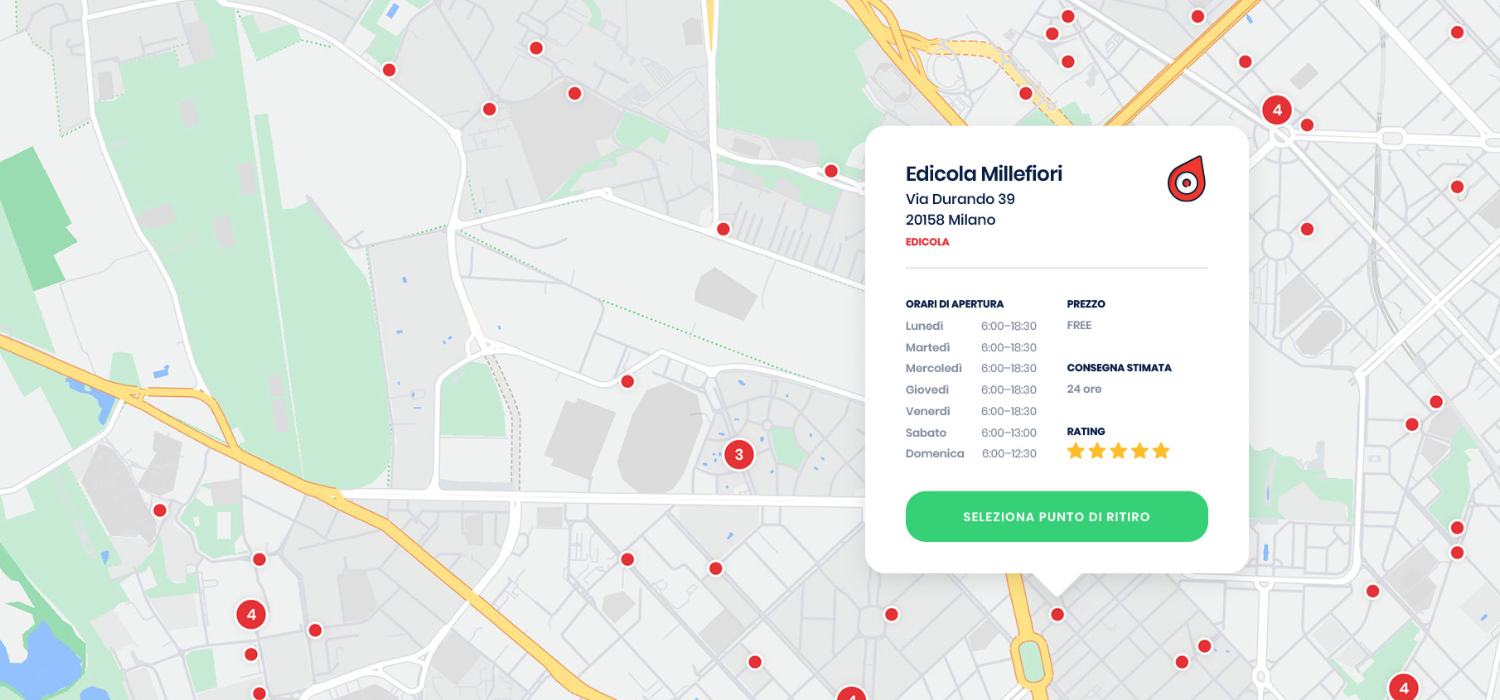

In fact, thanks to our technology it is possible to upload and enable a physical network of stores on our map, thus merging the Click & Collect pickup services in the proprietary stores with those of the Points of Proximity operated by third parties, allowing customers to purchase a wide range of products online while maintaining control over the in-store delivery processes in the case of C&C and also saving on shipping costs.

You can then create a customized logistical UX on your check-out by merging your store network with the more than 125,000 Pickup Points and Lockers already active nationwide and internationally in the GEL Proximity network.

Learn more about our services, or contact us for more information.