eCommerce continues to grow rapidly across Europe, with billions of parcels delivered each year to eShoppers increasingly demanding speed, efficiency and quality of service.

It is easy to imagine how all this creates not inconsiderable pressure on the entire logistics system, as well as problems – serious ones – with regard to environmental impact.

However, and this is a positive note, throughout Europe a greater awareness is developing, both on the part of consumers and eCommerce providers, about these issues, paving the way for alternative and more sustainable solutions, such as so-called Out Of Home delivery, a viable solution that provides greater flexibility, lower costs and reduced environmental impact compared to traditional home delivery through the use of Lockers and Pick-up Points.

But where are we in Europe? And which European countries are most advanced in this respect? In this article, we give you a detailed overview of the state of the art of Out of Home in Europe, to help you understand where we are and what still needs to be done.

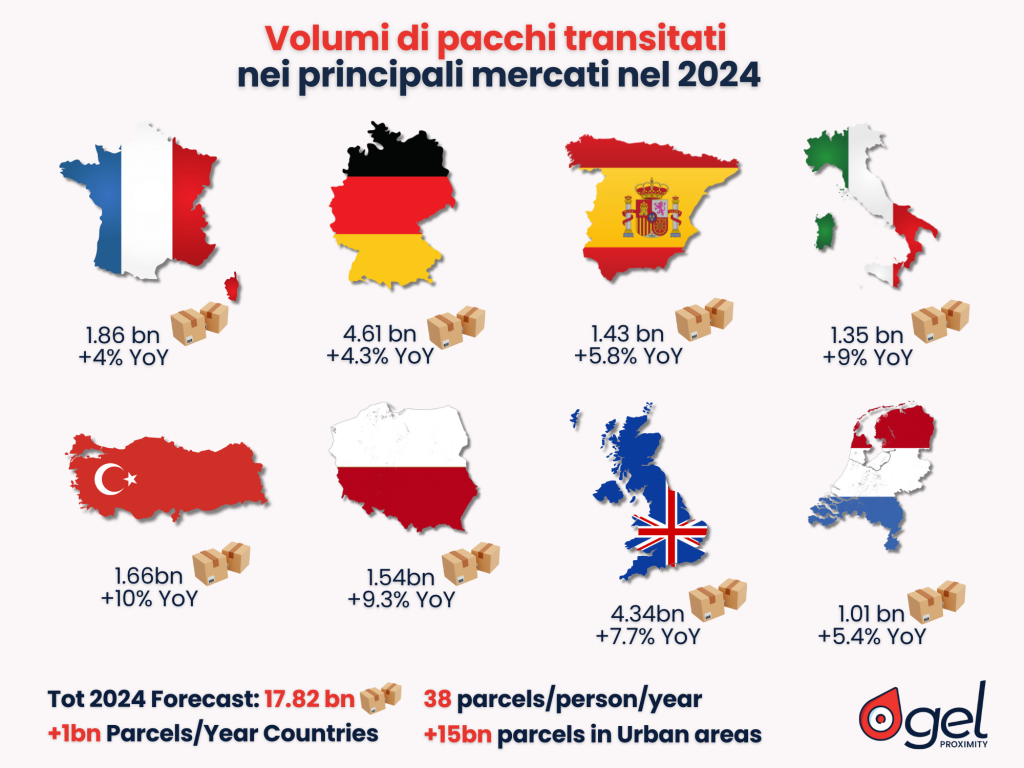

Volume of parcels in major markets

In 2024, in the main markets surveyed – Italy, France, Germany, Spain, the United Kingdom, Poland, the Netherlands and Turkey – a total of 17.82 billion parcels transited, a significant increase of 1 billion parcels compared to the previous year. Of these, around 15 billion transited in urban areas. This translates into an average of 38 parcels per person per year, out of a total population of 471 million.

Going into more detail, however, we find that the number of parcels handled varies considerably from country to country:

- 61 billion parcels transited in Germany in 2024, or +4.3% year-over-year (YOY)

- 34 billion parcels transited the UK in 2024 (+7.7% YoY)

- 86 billion parcels transited in France in 2024 (+4% YoY)

- 66 billion parcels transited Turkey in 2024 (+10% YoY)

- 54 billion parcels transited in Poland in 2024 (+9.3% YoY)

- 43 billion parcels transited in Spain in 2024 (+5.8% YoY)

- 35 billion parcels transited in Italy in 2024 (+9% YoY)

Countries such as Germany and the UK dominate the market thanks to already established logistics infrastructures and high eCommerce adoption rates; while markets such as Turkey, Poland and Italy show faster growth rates, indicating an accelerated adoption of online commerce, therefore to be watched in the coming years.

However, between the lines, these numbers also send another very clear message: the steady growth of eCommerce brings with it new logistical challenges, including optimising last-mile delivery.

The growth of out-of-home deliveries

As we mentioned at the beginning of this article, as the volume of parcels increases, so does the need for more efficient logistics solutions. Amongst these, Out of Home (OOH) deliveries – i.e. pick-ups at automatic Locker or Pick-Up Drop-Off Points (PUDO) – are becoming increasingly popular.

The reason, or rather, the reasons, are quite simple to guess: not only do these solutions provide greater flexibility to customers, who can choose where and when to pick up their online orders or make a return, but the adoption of these solutions also contributes to improving and making logistics management more efficient, reducing costs for merchants and lowering the environmental impact of last mile logistics (which we remember is the most polluting part of the entire logistics chain).

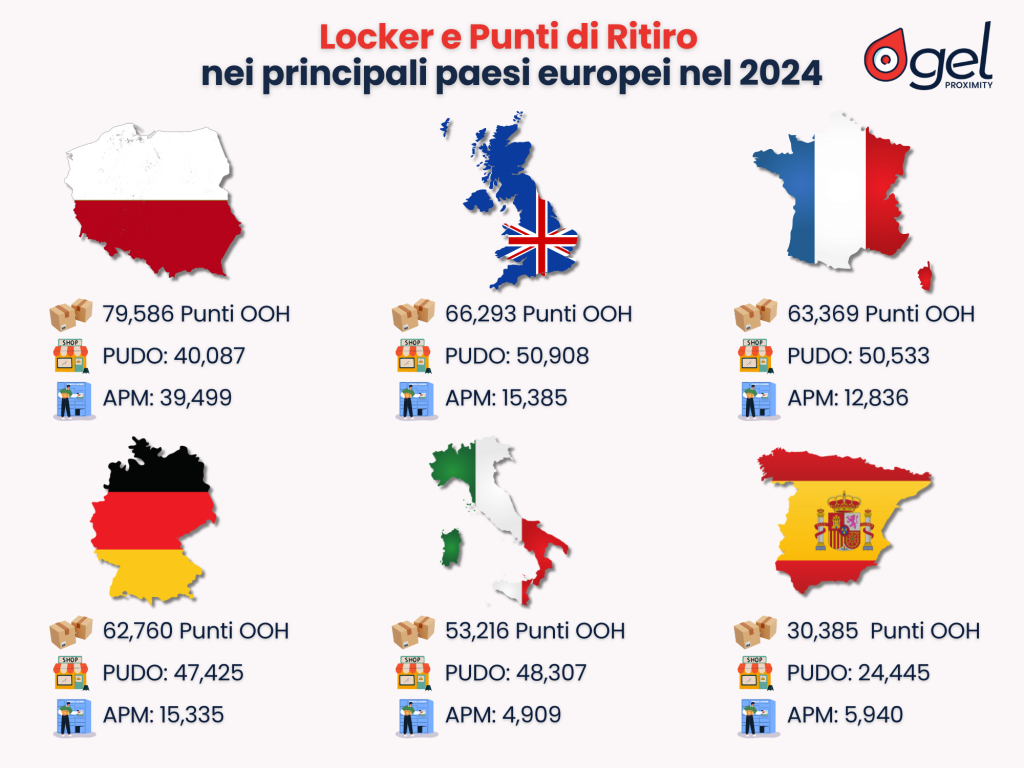

Lockers and Pick-up Points in Different Countries

Analysing the data existing to date on the number of Lockers and Pick-up Points available in the different countries, we find that, once again, the situation varies, and by a lot, from country to country.

Our source is the report ‘Out of Home Delivery in Europe 2024’ by Last Mile Experts. Here is what this valuable study reveals to us:

- In Poland there are approximately 79,586 unique OOH points, divided between PUDO (40,087) and APM – Automated Parcel Machines (39,499)

- There are approximately 66,293 unique OOH points in the UK, split between PUDO (50,908) and APM (15,385)

- There are approximately 63,369 unique OOH points in France, divided between PUDO (50,533) and APM (12,836)

- There are approximately 62,760 unique OOH points in Germany, divided between PUDO (47,425) and APM (15,335)

- There are approximately 53,216 unique OOH points in Italy, divided between PUDO (48,307) and APM (4,909)

- There are approximately 30,385 unique OOH points in Spain, divided between PUDO (24,445) and APM (5,940)

As always, the data speak for themselves: in Europe there is still a disparity in the adoption of Locker and Pick-up Points, with Poland firmly leading the ranking with almost 80,000 thousand unique points on its territory equally divided between PUDO (40,087) and APM (39,499), suggesting a strong logistics infrastructure responding to the needs of increasingly flexibility-oriented consumers.

The Polish case

With more than 40 per cent of all deliveries passing through Pick-up Points, Poland has been able to quickly reap the benefits of Out of Home deliveries, and has been able to offer efficient and sustainable solutions that are helping to optimise last-mile logistics.

We have also talked about the situation in Poland, the European leader in OOH deliveries, in a dedicated article on our blog, as well as a dedicated analysis of each of the countries listed above: France, Germany, Spain and the UK.

Don’t miss the insights into other interesting European markets: the Netherlands, Czech Republic, Denmark, Finland, Sweden, Belgium, Portugal, Switzerland, Romania and Austria.

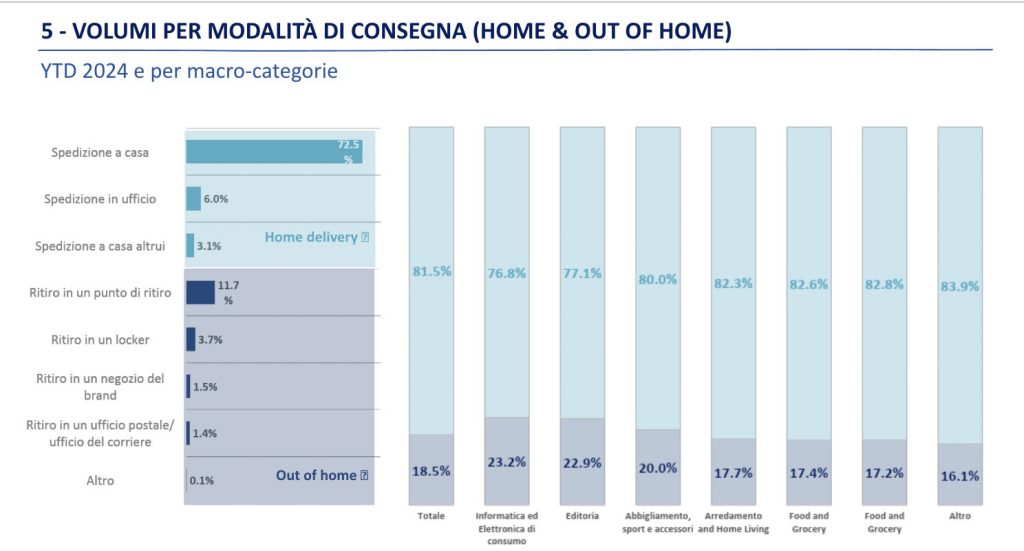

The Adoption of Lockers and Pick-up Points by Users

Having analysed the infrastructure available in the different European countries, one only has to ask how much users, i.e. eShoppers, actually make use of these solutions.

Once again, we find that the adoption of Out of Home delivery varies from country to country, with some markets more mature than others.

- In Poland, where we have seen that the network of Lockers and Pick-up Points is the largest in Europe, eShoppers are champions of Out of Home, with more than 40% of deliveries going through Lockers and Pick-up Points, thanks also to the strong network of InPost.

- In Germany and the UK, where the available infrastructure in any case has considerable numbers, around 30-35% of purchases are picked up by customers at PUDO or APM.

- In France, Italy and Spain, on the other hand, the share is between 15-25%, but growing strongly. In Italy, for instance, the use of Out of Home deliveries has shown significant growth in recent years. According to Netcomm data, from 2014 to 2023, deliveries at Pick-up Points and Lockers increased from 7.3% of total product purchases to 15.9% in 2022, and increased again in 2023 to 18,5%.

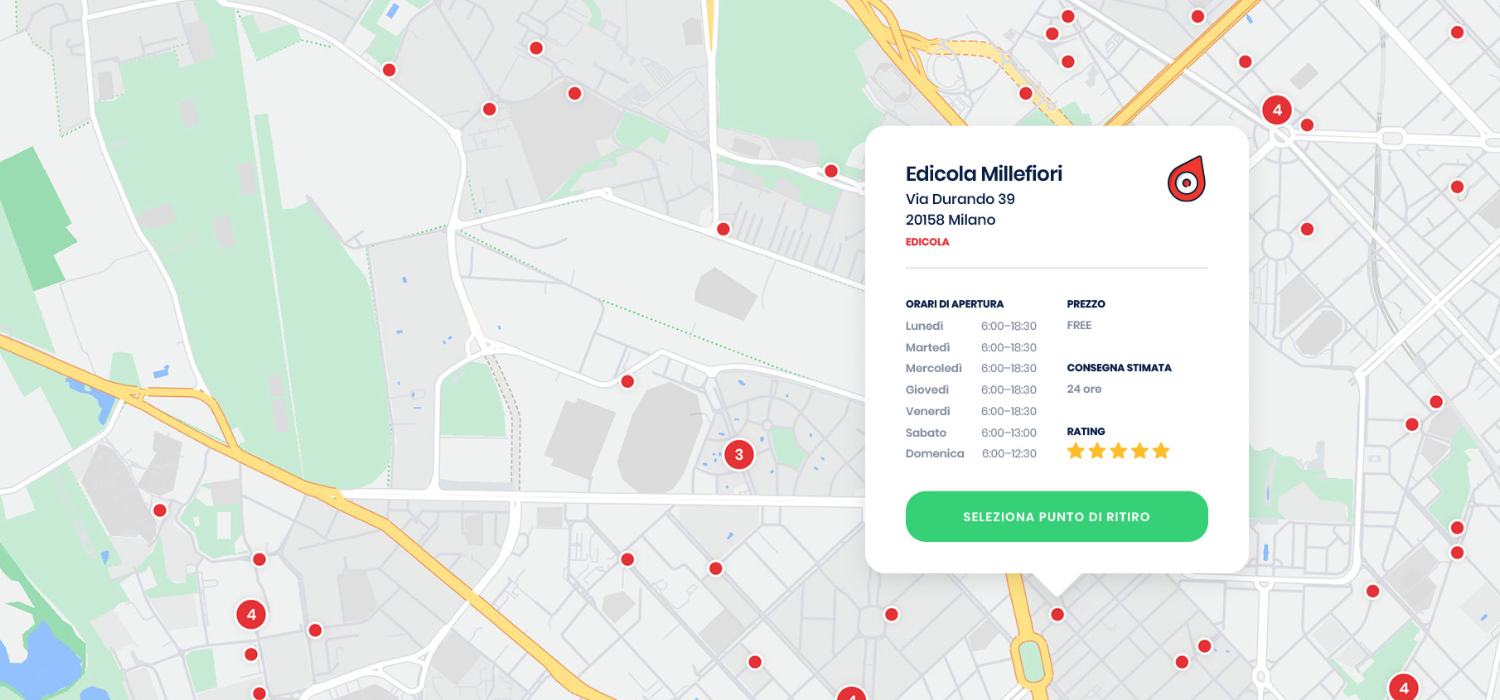

Screenshot

What the adoption of Out of Home deliveries in Europe depends on

The gradual increase in the number of parcels delivered by Out of Home mode throughout Europe in recent years shows that consumers increasingly appreciate the convenience offered by these solutions, which allow them to pick up parcels at any time, without time constraints linked to the presence of a courier.

As we have seen, the continuous expansion of the e-commerce market and the consequent increase in the volume of parcels is forcing us to rethink delivery models and find alternative solutions that are more efficient and sustainable both economically and environmentally. Indeed, Out of Home deliveries represent a strategic solution to meet the challenges of last-mile logistics

However, the evolution of this sector also passes through digitisation and technological innovation. Apps and digital platforms play a key role in improving the accessibility and efficiency of Out of Home deliveries, allowing consumers to book pick-ups, track parcels in real time and choose the most convenient pick-up point. Furthermore, integration with digital payment systems and loyalty programmes could further boost the adoption of these solutions.

To support this transition, logistics companies and retailers will need to invest in a widespread and technologically advanced infrastructure, ensuring an increasing number of Lockers and Pick-up Points in urban and peripheral areas. It will also be crucial to improve the user experience, reducing waiting times, increasing security and offering increasingly customisable options for parcel collection.

Finally, the active promotion of these solutions through awareness-raising campaigns on the environmental and economic advantages of Out of Home deliveries could accelerate their uptake. As awareness of sustainability issues and the reduction of CO₂ emissions increases, consumers will be more and more inclined to choose alternative delivery methods that combine convenience, efficiency and environmental friendliness.

GEL Proximity, your technology partner for Out of Home deliveries in Italy and Europe

GEL Proximity is the first aggregator of Lockers and Pick-up Points with a Proximity Network consisting of tens of thousands of newsstands, stationers, post offices, lockers, tobacconists, shops and petrol stations.

GEL Proximity technology allows easy access to the services of all available Networks, eliminating integration and maintenance costs.

By choosing GEL Proximity, you can immediately start offering your customers the possibility to pick up their orders online from over 300,000 already active Pick-up Points across Europe, quickly and easily.

You can connect GEL Proximity using our dedicated libraries and APIs, or by downloading the module from the marketplace of your eCommerce software.