Our European journey to discover the most interesting eCommerce marketplaces continues. After analyzing Spain, France, the Netherlands and most recently Germany, it’s time for Poland, Europe’s ninth largest country and sixth most populous country in the EU.

The growth of the eCommerce channel in Poland

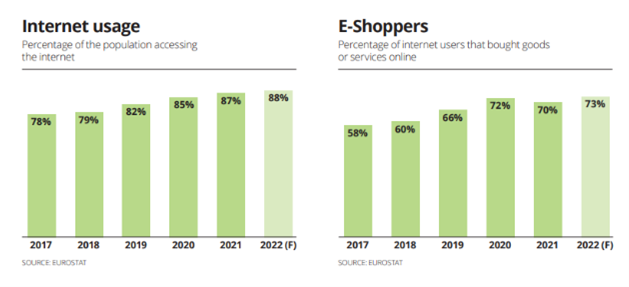

Of the approximately 38 million people who reside in the country, 88 percent have access to the Internet, and in 2022, according to data from the European Ecommerce Report, 73 percent of the population made online purchases via the eCommerce channel (just five years ago, in 2017, the percentage stood at 58 percent).

In recent years, however, the online sales market in Poland has witnessed rapid growth, placing it in 21st position in terms of market size in Europe with a projected turnover of approximately $16,608.4 million by 2023 (CAGR 2023-2027 of 10.7%) and in 13th position among the world’s fastest developing eCommerce markets. In fact, online commerce appears to be among the most relevant drivers of the country’s economic development, and 60 percent of warehouse space in the country is occupied by eCommerce logistics operators.

A pre-Covid boom

According to a study conducted by Ecommerce foundation, the rapid growth of the Polish eCommerce market began even before Covid, which, as we know, has been a major factor in the growth of sales worldwide. During 2019, in fact, Polish eCommerce saw a 25 percent increase in earnings over the previous year. Then, in 2020, the digital economy accounted for 12 percent of the national GDP. Poland’s eCommerce market growth remained in double digits during 2022 as well, and according to analysts at Polish Market Review – one of the leading market research and analysis companies in Central and Eastern Europe – the eCommerce services market in Poland will grow by 100% by 2027, spurred primarily by strong demand spurred by an optimal labor market situation and rising population incomes

Polish eShoppers

The number of people buying online is increasing rapidly in Poland, as is the frequency of purchase: in the last quarter of 2021, as reported by the European Ecommerce Report 2022, 30% of eShoppers placed 1 or 2 online orders; 36% between 3 and 5 orders; and 34% over 6.

Of these, as many as 94% bought from domestic retailers; 11% from retailers in other European countries; and only 7% from countries in other parts of the world.

What Poles Buy Online

The rapid development of eCommerce and the willingness on the part of consumers to make increasingly frequent and habitual use of this mode of shopping therefore represents a great opportunity for retailers, especially those in fashion, which is the most popular sector and accounts for 30.9% of Polish eCommerce revenue. This is followed by consumer electronics with 20 percent, food and beauty with 18.1 percent, furniture and appliances with 17.4 percent, and finally toys and hobbies with the remaining 13.6 percent.

Barriers to eCommerce according to Polish eShoppers

Among the barriers that would hinder the development of eCommerce according to Polish eShoppers we find in the first position with 52% the preference for shopping in retail outlets, either out of habit, loyalty to their trusted stores or the desire to be able to touch the goods before finalizing a purchase. The gap with respect to the other reasons given by Polish eShoppers is remarkable: only 9% believe that they lack the “skills” necessary to be able to make an online purchase; an even smaller percentage (5%) say they have little confidence in online payments; while only 1% consider the costs and delivery times too high.

On the delivery services front, then, Polish eShoppers turn out to be the most satisfied among the European countries surveyed, including on the issue of delivery sustainability.

Sustainable ecommerce

According to Patrycja Sass-Staniszewska, President of the Digital Chamber of Economy, in fact, “Polish eShoppers believe that the sustainability of eCommerce in Poland is an advantage in the landscape of the European online sales market. The social responsibility of the Polish eCommerce market is estimated at 3.89 on a scale of 1 to 6, and 68% of the eShoppers surveyed believe that the Polish eCommerce market is more socially responsible than the international market.”

Locker in Poland

Fostering the sustainability of online shopping in Poland is certainly an extensive Locker Network, thanks in part to the presence in the territory of InPost, a Krakow-based entity among the best-known logistics operators to provide Out Of Home services such as Lockers and Pickup Points. In fact, the Polish company, which can count on clients such as Amazon and Allegro – Poland’s best-known marketplace – aims for 2023 to expand further in the territory where it already has almost 20 thousand Lockers for parcel delivery (only five years ago there were 3500).

At the same time, Alibaba’s logistics arm, Cainiao, has also set its sights on deliveries via Locker for the Polish market, joining DHL and investing more than 60 million euros for a Network of lockers for pickup and return of online orders aiming to become the largest OOH delivery network in the Polish market. In fact, according to DHL, 40% of Polish consumers prefer delivery at an automated parcel vending machine (APM).

Poland, therefore, strongly believes in these alternative delivery modes that can not only provide greater environmental sustainability, but also greater flexibility and convenience for its customers.

If you also believe that Lockers and Pickup Points represent the future of eCommerce deliveries (just like us), you are in the right place! In fact, GEL Proximity allows you to integrate online stores with tens of thousands of Pickup Points and Lockers that are already active throughout the country and internationally.

Contact us now to find out how to quickly and easily integrate our Network to your online store.